36+ Principal 401k withdrawal calculator

To get the most out of this 401 k calculator we recommend that you input data that reflects your retirement goals and current financial situation. Quickly see whether youre on track with your retirement goals and see which small changes could add up to a potentially big impact.

2

Add up all of your income.

. The goal of a retirement withdrawal calculator is to figure out how much you withdraw from savings without running out of money before you run out of life. 401 k Early Withdrawal Costs Calculator Early 401 k withdrawals will resu See more. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Print Share Use this calculator to estimate how much in taxes you could owe if you.

1 IRS annual limits for 2022. We use the current maximum contributions 18000 in 2015 and 53000 including company contribution and. If you dont have data ready.

This is a very. First how much are your investments presently worth. You decide to increase your annual withdrawal by 35 and want the money to last for 35 years with nothing left for heirs after that time.

Not an easy task. Early withdrawals from IRAs or 401ks are both subject to a 10 penalty along with standard income taxes. To calculate your investment withdrawal amount for this year well need to answer a few questions.

It is mainly intended for use by US. We designed the present savings withdrawal calculator to find the answer to all the above questions. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment return.

While it is most frequently used to calculate how long an investment will last assuming some. If there is 2 percent of inflation which is the target rate of inflation in the US and most countries you will withdraw 12240 dollars in the following year. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. 25Years until you retire age 40 to age 65. You will find the savings withdrawal calculator to be very flexible.

To give you an idea 20000 in a 401 k 403 b or 457 b account could triple in 20 years at an average 7 rate of returnbut not if you withdraw it today. Individuals will have to pay income. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus.

Moreover you can also check how many times can you withdraw from a. Log in to see your. Your employer needs to offer a 401k plan.

The advantage of the 4. Traditional IRAs and 401ks are two of.

Pdf Ijalel Vol 4 No 1 2015 International Journal Of Applied Linguistics English Literature Ijalel Rahman Sahragard Hmoud Sanad G Alotaibi Samira Aliakbari Haleh Parsa Mehrdad Farahani Sara Quintero Assoc Prof Dr

2

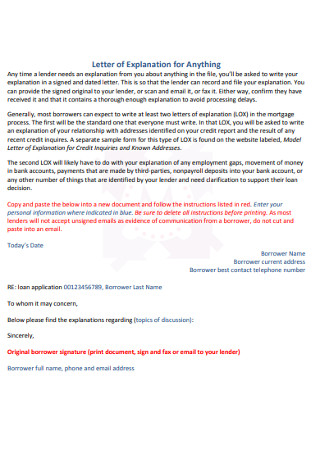

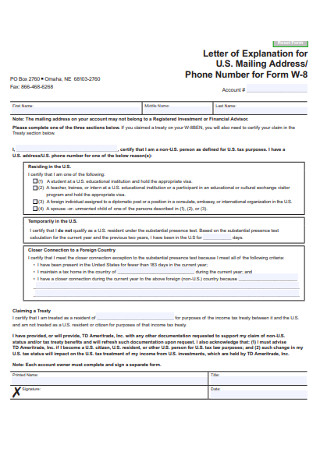

36 Sample Letter Of Explanation Templates In Pdf Ms Word

36 Sample Letter Of Explanation Templates In Pdf Ms Word

36 Sample Letter Of Explanation Templates In Pdf Ms Word

Semis And Finals Mmw Pdf Level Of Measurement Mean

36 Sample Letter Of Explanation Templates In Pdf Ms Word

Nba Salary Cap Faq

2

2

Pdf Thornley A W 1979 Thesis Fijian Methodism 1874 1945 Buka Sokovagone Academia Edu

2

Semis And Finals Mmw Pdf Level Of Measurement Mean

36 Sample Letter Of Explanation Templates In Pdf Ms Word

36 Sample Letter Of Explanation Templates In Pdf Ms Word

2

2