Fidelity ira calculator

Beneficiary IRA Distribution Calculator. If inherited assets have been transferred.

What Is The Best Roth Ira Calculator District Capital Management

Roth Conversion Calculator - Fidelity Investments Roth IRA Conversion Calculator Is converting to a Roth IRA the right move for you.

. In 1997 the Roth IRA was introduced. Protect your retirement with Goldco. All tax calculators tools.

Contributions to your Traditional IRA are usually tax deductible now but you pay taxes when. Net Business Profits From Schedule C C-EZ or K-1 Step 3. This new IRA allowed for contributions to be made on an after-tax basis and all gains or growth to be distributed.

This calculator will assist clients in determining their eligibility for a Traditional or Roth IRA and illustrate the potential maximum annual contribution. This calculator assumes that you make your contribution at the beginning of each year. Ad Visit Fidelity for Retirement Planning Education and Tools.

Use this calculator to compute the amount you can save in a tax-deferred Traditional IRA. A spousal IRA allows a working partner to open an individual retirement account IRA for a non-working spouse to save for retirement. Ad Private secure any device no installs or downloads.

Interactive with just-in-time advice and reporting. Use this interactive tool to see how charitable giving can help you save on taxesand how accelerating your giving with the bunching strategy may help save even. This calculator helps you assist an IRA beneficiary in calculating the amount heshe is required to withdraw each year from the inherited IRA.

Take our Free Strategy Quiz to see how Avior can help plan your retirement holistically. Request Your Free 2022 Gold IRA Kit. With this tool you can see how prepared you may be for retirement review and.

You must have compensation to make a. It is important to. The Planning Guidance Center helps make it easy to get a holistic view of your financial plan from one place.

This calculator can help you decide if converting money. RMD amounts depend on various factors such as the decedents age at death the year of death the type of beneficiary the account value and more. Ad Visit Fidelity for Retirement Planning Education and Tools.

You must have compensation to make a. Your Contribution Amount is. By thousands of Americans.

Roth IRA Conversion Calculator. Ad Top Rated Gold Co. Claim 10000 or More in Free Silver.

If you have any questions call a. SEP-IRA Calculator Results. This calculator will assist clients in determining their eligibility for a Traditional or Roth IRA and illustrate the potential maximum annual contribution.

This calculator helps you assist an IRA beneficiary in calculating the amount heshe is required to withdraw each year from the inherited IRA. That can be especially beneficial in. Ad An economic downturn is coming.

Beneficiary IRA Distribution Calculator. This calculator assumes that you make your contribution at the beginning of each year. Please enable it to continue.

Are you confident your finances with weather the storm. The amount you will contribute to your Roth IRA each year. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck.

For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. Were sorry but price yield calculator doesnt work properly without JavaScript enabled.

What Is The Best Roth Ira Calculator District Capital Management

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Roth Ira

Proper Asset Allocation Of Stocks And Bonds By Age New Life Financial Samurai Stocks And Bonds How To Get Money Bond

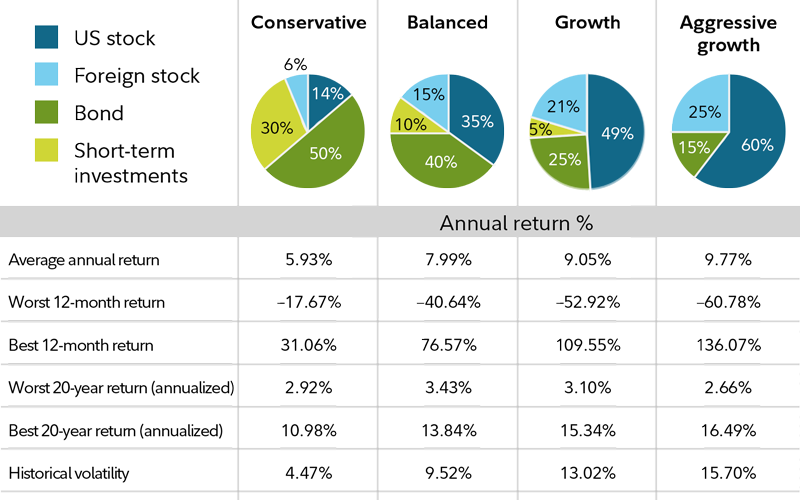

Risk Tolerance And Time Horizon Fidelity

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

401 K Savings Guidance Chart Saving For Retirement 401k Chart Finance Education

1

Roth Conversion Q A Fidelity

Download The Credit Card Payoff Calculator Paying Off Credit Cards Credit Card Payoff Plan Secure Credit Card

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workpl Contribution Retirement Benefits Savings Plan

3

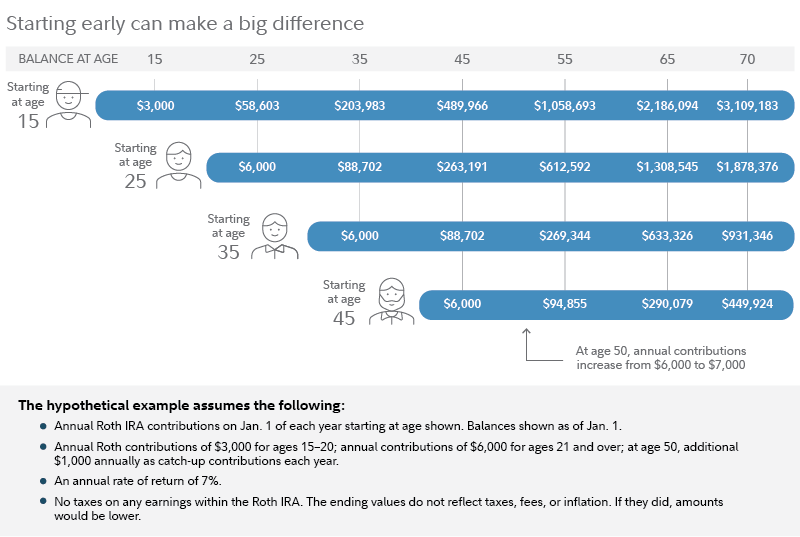

Contributing To Your Ira Start Early Know Your Limits Fidelity

Roth Ira For Kids Fidelity

1

1

How To Invest Your Ira Fidelity Investing Investment Portfolio Saving For Retirement

Pin On Parenting